Posts

To the Sep 31, 2008, the us registered a good complaint and agree order in You v. Earliest Lowndes Financial (Meters.D. Ala.). The fresh criticism alleged your bank engaged in a routine or habit of discerning facing African-American people by asking her or him large rates of interest for the are built homes finance than simply also based light people, within the solution of your Reasonable Houses Operate (FHA) and the Equal Credit Possibility Operate (ECOA). Underneath the agree purchase, First Lowndes Bank will pay to $185,100, and attention, to pay African-American consumers have been energized high rates.

Undertake Money

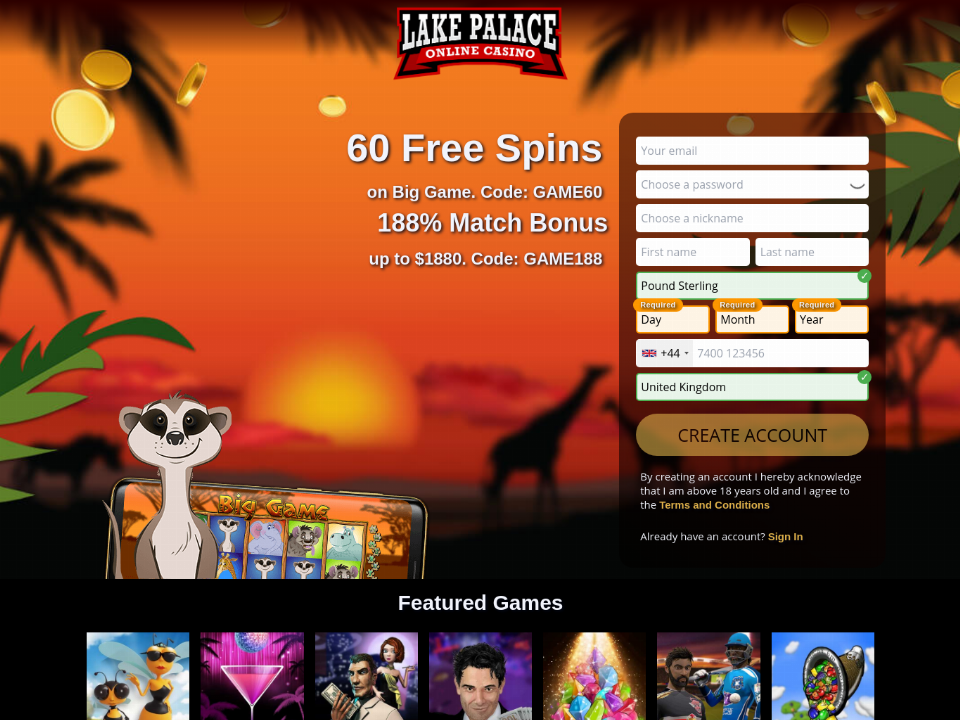

Microgaming may be one of the greatest game company, however, participants usually are not starved to own possibilities when searching for another thing. The newest international online casino wagering industry is chock-full of different online game organization, which means that there Click This Link are also more games to try out. Anybody else really worth playing is games enterprises such as NetEnt, Boongo Video game, Amatic Opportunities, Amaya Gambling, Ezugi, Pragmatic Play, Playson, Advancement Gaming, and you can Habanero. This type of include a listing of online slots games with loads to offer such as; Day of the fresh Inactive, Immortal Relationship, Super Moolah, Nice Party, Jackpot Icon, Chronilogical age of the brand new Gods, Sea Treasures, and you will Portal Learn Dice.

Bank7

The new suit and alleges the defendants’ conduct comprises a period or habit of discrimination or a denial from rights so you can an excellent group of people. Beneath the payment, the fresh defendants must pay all in all, $30,five hundred to 3 victims of discrimination, a supplementary $forty-five,100 on the bodies because the a municipal punishment and prevent the fresh so-called discriminatory strategies. The newest payment means GuideOne to practice insurance coverage agencies on the commitments underneath the Fair Houses Operate and provide periodic account to your Justice Service. For the November 30, 2012, the new court registered a consent decree in United states v. Geneva Terrace (W.D. Wis.).

Following count are regarded all of us, we extra a state that the defendants had engaged in an excellent pattern or habit of homes discrimination. Our very own criticism so-called that the defendants refused to allow it to be a light citizen during the playground to sell his unit in order to Latina individuals; informed a are created home sales representative one to she couldn’t offer these devices to Hispanic people; and made derogatory statements on the Hispanics to several people, such as the HUD investigator. The concur decree, submitted for the August 16, 1999, provided $92,five hundred inside financial rescue ($75,100 for the complainants, a $ten,100000 civil punishment and $7,five hundred inside the attorney’s charges), fair houses degree to your defendants, and you may reporting and you can monitoring criteria to your period of the decree. To your December 29, 2002, the usa Attorney’s Work environment to your Region out of Minnesota recorded a consent decree on the courtroom solving You v. Gustafson (D. Minn.).

M&T Financial

The new defendants features provided to spend $step three,five hundred, to go to training supplied by the brand new Idaho Fair Housing Council, also to conform to other marketing revealing requirements. For the Oct 15, 2012, legal entered an america recorded an excellent concur order in All of us v. Luther Burbank Deals (C.D. Cal.). The ailment, which had been filed to your Sep several, 2012, alleged the ones from 2006 to help you 2011, Luther involved with a period or practice of discrimination in its residential credit issues inside the admission of your Fair Property Act and you may Equivalent Borrowing from the bank Options Operate. During that time several months, Luther implemented a great $eight hundred,one hundred thousand minimum loan amount plan for its general single-loved ones domestic home loan program. The usa alleges that the rules or behavior had a good disparate affect the basis of race and you will federal resource. Within the settlement Luther have a tendency to purchase $1.one million within the another funding program to improve the newest residential home loan borrowing from the bank your lender reaches certified consumers regarding the affected section seeking to financing from $400,one hundred thousand or quicker inside California.

Farmers & Resellers Condition Bank

The fresh complaint so-called the defendants engaged in a pattern or practice of creating and developing multifamily property developments otherwise denying liberties to help you several persons within the admission of your FHA and you may the brand new ADA. On the August 13, 2014, the new courtroom entered a consent decree in Us v. Martin Family members Trust (N.D. Cal.). The problem, filed to the Oct twenty-five, 2013, alleged that the manager, manager, and personnel away from Forest Lawn Leases discriminated up against four complainant families and you can an area fair housing team on such basis as familial position and you can involved with a period or habit of discrimination facing family members which have college students.

The newest accused, a national mortgage lender with 168 offices within the 32 says became one of several nation’s 20 largest FHA lenders from the 2009. PrimeLending didn’t have monitoring in position so that it complied to your reasonable credit laws, whilst they increased to originate over $5.5 billion within the finance a year. The newest agree buy necessitates the defendants to pay $dos.0 million to the subjects of discrimination and have inside the put mortgage costs principles, overseeing and you will staff training you to definitely make certain discrimination will not take place in the near future. On the April 15, 2009 the newest courtroom joined a good concur decree in Us v. Milton (D. Idaho), a fair Housing Act election situation known by HUD. The problem, which was registered to the February 16, 2009, by the United states Attorney’s Place of work alleged that the defendants violated the newest Fair Property Act based on familial position whenever they refused to rent a second-floors unit in order to a father since the he previously two young children.

East Boston Deals Lender

The complaint, filed, to the November ten, 2005, alleged the newest Accused broken the fresh Fair Property Operate when she refused in order to lease an apartment so you can an enthusiastic African-Western boy because of competition and made comments in terms of the newest leasing of an apartment showing a preference otherwise restrict centered for the battle. The newest concur buy offers up $17,500 inside the monetary damages and you may injunctive rescue and will remain in impression for three many years. On the Sep 31, 2020, the united states recorded a keen election complaint in Us v. Vegas Jaycees Seniors Mobile Family People (D. Nev.). For the November 2, 2018, the us filed a great complaint and you can inserted to your an excellent payment agreement resolving All of us v. Hudson Valley Federal Borrowing from the bank Partnership (S.D.N.Y.).

Area List To possess A good Financial Connection with Your regional Bank

To the August 30, 2011, the united states compensated their related states up against Penny Pincher, the fresh newspaper in which the advertising looked. That concur decree needed Cent Pincher to expend $10,100 inside the damages so you can Gulf Shore Reasonable Housing Cardiovascular system, $step 1,five hundred in the damages to your personal influenced by the brand new ad and you will $step 3,five hundred inside a civil penalty to the United states. The fresh settlement along with necessary Penny Pincher to consider a non-discrimination rules, to add the personnel having reasonable property knowledge, also to give unexpected accounts to your Justice Agency. On the January 29, 2003, the courtroom entered a consent decree in All of us v. Maldonado (D. Kan.). The orginal problem, filed for the March 13, 2002, allegated one Trinidad Maldonado, who owns the fresh Midway Mobile Home Playground inside Junction City, Kansas, intimately harassed ladies tenants, several of which was the newest spouses of men stationed at the regional Feet. The us so-called one to Mr. Maldonado made repeated and you may unwelcome intimate comments to help you women tenants, provided females tenants decrease in their rent and other privileges inside replace to own intimate acts, inserted ladies tenants’ trailers instead consent and you may instead a valid reasoning, and inappropriately moved ladies tenants.

The criticism, filed for the September 30, 2010, alleged the new defendants don’t structure and create a good 143-equipment apartment building in the New york inside compliance on the Reasonable Property Act’s usage of advice. The partial decree to the developer, L & M 93rd Road LLC will bring a keen injunction facing discriminating for the foundation out of impairment since the blocked because of the Reasonable Homes Operate. It will take retrofits out of specific noncompliant features on the personal and you may common-explore section and you may inside the homes from the Melar, and you can assessment by the a neutral 3rd party to be sure utilization of this type of retrofits. The newest decree requires the offender to disclose to your You organized multi-members of the family construction and you can specifies ensures you to definitely for example framework tend to comply with the fresh FHA. The new decree necessary that the brand new defendants will pay around $180,000 to compensate persons aggrieved because of the alleged discriminatory property strategies during the Melar in addition to a municipal punishment from $40,one hundred thousand. The newest partial decree in addition to requires the defendant to determine an accessibility Endeavor Fund from $288,300 to pay for establishment or services (perhaps not or even required by law or even the decree) at the Melar to have people which have handicaps, or comparable features or products that promote access to in the most other safeguarded functions which is often centered in the three-year name of your decree.